Need Help Buying a home in Gainesville Ga? Call or Text Shannon 706-969-4210

The Ultimate Guide to Buying a Home in Gainesville GA

Expert Tips and Local Insights

Buying a home in Gainesville, GA, is an exciting and significant investment.

Nestled in the foothills of the Blue Ridge Mountains, Gainesville offers a blend of suburban charm and natural beauty. With a competitive real estate market, understanding local trends and financial options can give buyers an edge.

The average down payment on a house in Georgia typically ranges from 3% to 20% of the home’s purchase price.

Whether opting for a conventional loan or exploring government-backed options like FHA loans with lower down payment requirements, knowing your financial standing is crucial.

Additionally, expert guidance from a skilled real estate agent can streamline the home-buying process.

Selecting the right home involves more than just finding the perfect property. Comparing mortgage options, navigating negotiations, and closing the deal all play essential roles.

By focusing on these key elements, buyers can ensure a smoother and more informed journey to homeownership in Gainesville.

Key Takeaways

- Knowing local real estate trends is crucial.

- Down payments range from 3% to 20%.

- A good real estate agent can simplify the process.

Understanding the Gainesville, GA Real Estate Market

Gainesville, GA’s real estate market is experiencing a period of growth, characterized by competitive offers and rising home values.

This section dives into market trends, neighborhood profiles, and price expectations.

Market Trends

The Gainesville housing market is described as somewhat competitive. Homes typically receive an average of one offer and sell in approximately 39 days.

Home values have risen considerably, with typical home values around $346,446 as of recent data.

Over the past year, home values have increased by 4.7%, and the median sale price climbed to $385K.

Buyers should expect price fluctuations and opportunities for competitive offers.

Gainesville Area Profiles

Gainesville offers a variety of neighborhoods, each with its own unique charm and amenities.

Neighborhoods like the downtown area offer proximity to local shops and dining, while suburban areas provide quiet, family-friendly environments.

Community features, school districts, and proximity to recreational facilities can significantly influence a homebuyer’s choice.

Price Ranges and What to Expect

In Gainesville, the price range for homes varies significantly. The median sale price per square foot is around $196, and the average home price has reached $403,000 recently.

Homes in lower price ranges may include smaller properties or those needing some renovation, whereas higher-priced homes often come with more amenities and larger lots.

Potential buyers should be prepared for varied inventory, with prices reflecting the home’s size, location, and condition.

Financing Your Home Purchase

Financing a home in Gainesville, GA, involves understanding your budget, exploring various loan options, and getting pre-approved.

Each step ensures a smooth home-buying process by providing clarity and ensuring you get the best deal possible.

Assessing Your Budget

The first step in financing your home is assessing your budget.

This involves calculating your monthly income and expenses to determine how much you can afford to spend on a home.

To begin, list all sources of income and subtract regular expenses such as bills, groceries, and transportation.

Consider future expenses like maintenance and tax payments. Use the 28/36 rule: spend 28% of your monthly income on housing and keep total debt payments, including the mortgage, under 36%.

Home Loan Options

Understanding available home loan options is crucial. Several types of loans suit different buyers’ needs:

- Conventional Loans: These are not insured by the government and generally require higher credit scores and down payments.

- FHA Loans: Insured by the Federal Housing Administration, these loans require lower down payments and credit scores.

- VA Loans: Available to veterans and active service members, these loans often come with no down payment.

- USDA Loans: These are targeted at rural and small-town buyers with low to moderate incomes, sometimes requiring no down payment.

Comparing these options helps in selecting the best fit based on one’s financial situation.

The Pre-Approval Process

Getting pre-approved for a mortgage is a critical step. It involves a lender reviewing your financials to approve you for a specific loan amount.

Pre-approval provides a realistic budget and strengthens your offer to sellers. Gather necessary documents, including proof of income, credit history, and assets.

Submit these to lenders who will run a thorough check. This ensures you understand your borrowing capacity and facilitates a smoother purchasing process.

By diligently following these steps, prospective homeowners in Gainesville, GA, can secure favorable financing terms and confidently proceed with their home purchase.

The Home Buying Process in Gainesville, GA

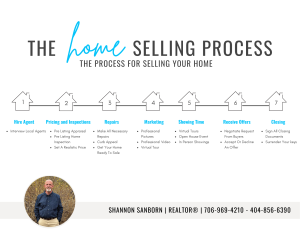

Navigating the home buying process in Gainesville, GA involves several key steps. From searching for the perfect home to closing the deal, each phase requires careful consideration and action.

Searching for Your Ideal Home

The search for a home in Gainesville begins with identifying your needs and wants. Potential homebuyers should consider factors such as proximity to schools, workplaces, and amenities.

Neighborhood research is crucial; each area has its unique characteristics.

Utilizing online real estate platforms and working with a local real estate agent can provide access to the latest listings and market trends. Visiting open houses and scheduling private showings will also help you narrow down your options.

Making an Offer and Negotiating

Once the ideal home is found, the next step is to make an offer. This usually involves submitting a written proposal to the seller. Consult with your real estate agent to determine a competitive yet reasonable offer based on comparable properties in the area.

Negotiations may follow, addressing aspects like the price, closing date, and any contingencies.

It’s essential to remain flexible but also know your limits. Successfully negotiating the deal will result in a mutually agreed-upon contract.

Inspections and Appraisals

After an agreement is reached, it’s crucial to conduct home inspections. Professional inspectors will assess the property for potential issues, such as structural damage or outdated systems.

The findings may impact the terms of the purchase or prompt further negotiations with the seller.

An appraisal is also necessary to determine the home’s market value. This step is typically required by lenders to ensure the loan amount aligns with the property’s worth.

Both inspections and appraisals form vital checkpoints before proceeding to closing.

Closing the Deal

The final phase of the home buying process is closing. This involves signing the various legal documents to transfer ownership of the property.

Leading up to this, buyers should secure their financing, ensure all conditions of the contract are met, and prepare for any closing costs, which generally include fees for services like title insurance and escrow.

On the closing day, the buyer and seller (or their representatives) will sign the final paperwork, and the buyer will provide the necessary funds.

Once completed, the buyer receives the keys, officially becoming the new owner of the home.

HAVE QUESTIONS ABOUT MORTGAGES

CONTACT SAMANTHA FRASER!

Samantha Fraser – NMLS# 947647

(678)522-5548

Email: sfraser@gfshomeloans.com

Frequently Asked Questions

When buying a home in Gainesville, GA, potential buyers often have several questions regarding neighborhoods, budgeting, mortgage pre-approval, and more. This section addresses these common queries in detail.

What are the key factors to look for in a Gainesville, GA neighborhood before purchasing a home?

Key factors include safety, proximity to schools, availability of amenities, and overall neighborhood vibe. Research local crime rates and ensure the neighborhood meets personal and family needs.

What are the average home prices in Gainesville, GA, and how can I prepare my budget?

The average home prices in Gainesville, GA can range significantly. As of 2024, expect to find homes between $200,000 and $500,000 depending on size and location. Preparing a budget involves considering down payments, mortgage rates, and additional costs like insurance and property taxes.

What steps should I take to get pre-approved for a mortgage in Gainesville, GA?

Getting pre-approved for a mortgage involves reviewing your credit score, gathering necessary financial documents, and selecting a lender. Contact local banks or mortgage brokers to understand specific requirements, which may vary slightly among lenders.

Can you outline the home buying process specifically for Gainesville, GA?

The home buying process in Gainesville includes saving for a down payment, finding a real estate agent, getting pre-approved for a mortgage, and searching for homes. After submitting an offer, you’ll conduct inspections, secure financing, and finally close the deal.

What are the advantages of buying a home in Gainesville, GA compared to renting?

Owning a home in Gainesville offers the benefit of building equity over time, potential tax benefits, and the freedom to modify your living space. In contrast, renting may offer less financial stability and no return on investment.

What are some common mistakes to avoid when purchasing a home in Gainesville, GA?

Avoiding common mistakes includes conducting thorough property inspections, being aware of all associated costs, not rushing the decision, and ensuring proper understanding of the mortgage terms. Consulting with a real estate professional can also help in making informed decisions.

Curious about your home’s value?

Just fill out the form, and we’ll send you a Comparative Market Analysis (CMA) for your home.